What is Open Banking and why don’t we have it in Bermuda?

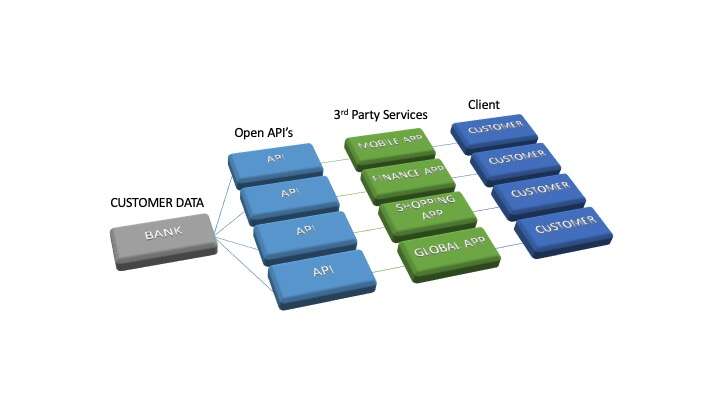

Open banking is a financial system that allows customers to securely share their financial data with authorized third-party providers, such as banks, fintech companies, and other financial institutions. This sharing of data is done through APIs (Application Programming Interfaces), which are secure connections that allow these providers to access and use the customer’s financial information.

The main goal of open banking is to provide customers with more control over their financial data and to create more competition and innovation in the financial sector. It is expected to bring a range of new products and services to the market, such as personal finance management tools, mobile banking apps, and other financial services that can be customized to meet the individual needs of customers.

One of the key benefits of open banking is that it allows customers to easily compare and choose financial products and services from a range of providers. This can result in better deals and lower costs for customers, as well as a wider range of products and services to choose from.

Another important benefit of open banking is increased security. The APIs used for open banking are highly secure, and the financial information shared is protected by strict privacy regulations. This helps to prevent fraud and protect customers from potential security breaches.

Open banking also provides customers with more control over their financial data. Customers can choose which financial information they want to share with third-party providers, and they can revoke access at any time. This means that customers are in control of who can access their financial information and how it is used.

Open banking is still a relatively new concept, and it is currently being rolled out in different countries around the world. In Europe, for example, open banking was introduced as part of the Second Payment Services Directive (PSD2) in 2018. This directive requires banks to provide customers with secure access to their financial data through APIs, and it also requires banks to share this data with authorized third-party providers.

In the UK, open banking has been in place since 2018, and it has already led to the development of a range of new financial products and services. Many UK banks now offer open banking services, and there are also a growing number of fintech companies and other financial providers that are offering products and services through open banking APIs.

Open banking is expected to continue to grow and evolve in the coming years, and it is likely that we will see even more innovative products and services being developed as a result. It is an exciting time for the financial sector, and it is clear that open banking has the potential to revolutionize the way we manage our finances.

In conclusion, open banking is a financial system that allows customers to securely share their financial data with authorized third-party providers. It provides customers with more control over their financial information, increased security, and the ability to compare and choose financial products and services from a range of providers. Open banking is still in its early stages, but it is expected to continue to grow and evolve, leading to new and innovative financial products and services that can help to improve the financial well-being of customers.

In the UK, for example, many of the major banks, such as Barclays, HSBC, and Lloyds, offer open banking services to their customers. These services allow customers to securely share their financial data with authorized third-party providers, who can then use this data to offer a range of financial products and services.

In addition to traditional banks, a growing number of fintech companies are also offering open banking services. These companies are leveraging open banking to provide customers with new and innovative financial products and services, such as personal finance management tools, mobile banking apps, and other financial services that can be customized to meet the individual needs of customers.

Other financial institutions, such as payment service providers and investment management firms, are also exploring the potential of open banking and are likely to start offering open banking services in the near future.

In summary, open banking is offered by a range of organizations, including banks, fintech companies, and other financial institutions. The goal is to provide customers with more control over their financial data, increased security, and the ability to compare and choose financial products and services from a range of providers.

The only question for us in Bermuda is when will the Bermuda based banks start opening up to allow us more control over available services, rather than less.